In these pre-potential recession days, there’s a lot of speculation as to whether the markets have hit bottom yet and just how bad a recession, if we have one, will be. Friends, as I’ve said before if anyone tells you that they can peg the bottom (or the top) of the markets, head for the hills: It’s simply not possible.

What we can do is interpret the information we have – including historical data from past recessions, trend lines over several months (and years), gut-instinct gauges of consumer sentiment, and our readings of the tape – to figure out when we’re probably getting pretty close so that each of us can make more confident moves based on the information at hand.

Let’s take a look.

How Much Did Markets Move Over the Last Few Years?

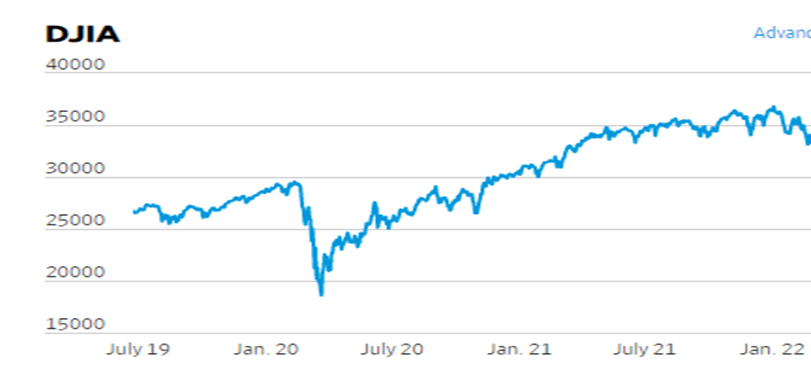

From my perspective, a good indicator of just how far the markets can dip on the verge of a recession is where they’ve recently been. Looking at the Dow, for example, we see that over the last three years (and with some unsteadiness due to the initial Covid-19 dip), in July 2019, it was just about 26,727. At its peak in January 2022, it was nearly 36,800. A gain of 10,000 points, or 37%, in three years, is nothing short of bonkers – and clearly, a reset has been overdue.

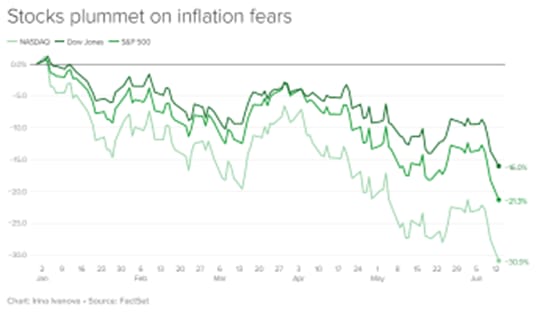

As I write this, it’s now at about 30,500, down about 18% from January’s high. This next graph shows the overall declines across the three major indices,

as reported by CBS News on June 14, before the Fed announced its 1% rate hike:

As noted in that same report:

“Stocks have historically declined almost 35% on average when a bear market coincides with a recession, compared with a nearly 24% average drop when the economy avoids a recession, according to Ryan Detrick, the chief market strategist at LPL Financial.

‘Going back more than 50 years shows that only once was there a bear market without a recession that lost more than 20% and that was during the Crash of 1987,’ Detrick said in a research note.

During other near-bear markets that occurred without a recession, stocks bottomed out at a roughly 19% decline, he added.”

So, if this aspect of economic history holds, we may not be at the bottom yet.

How Residential Real Estate Factors In

Here, too, we’ve seen (previously) unfathomable upward swings in home-sale prices. And for that reason, I predict we’ll see some easing – possibly as much as 10% in pricing, given that most markets went up 20-30% or more since 2019.

What does that mean for you? If you were among the lucky buyers who got in before 2019, you’ve made a tidy gain in equity, even with current rates of inflation, so do what you can to preserve and even grow it wisely (aka, don’t get a home equity loan and blow it on crypto, in my opinion). If you bought when the market topped out, it may take a while before you realize any real gains, but if you hold onto your home, history has shown that you will.

And if you’re still in the market for a home, keep in mind that higher interest rates impact your mortgage, yes, but they also impact everything that you will buy to decorate and furnish and maintain your home, so budget accordingly. Better to go with less home than you think you need right now and trade up when interest rates and market conditions are kinder than to get in over your head and wind up losing the roof you’ve worked so hard to put over it. That said, I always think residential real estate is a good investment, just be thoughtful, patient, and flexible if getting in now is your goal.

C/Kryptonite

Ugh, crypto, even with the setbacks so far, I know it will go on because there will always be a handful of people who get in at the front of the line (either by creating their crypto or having the right connections at the right time) and who tell their stories so that others buy-in and for the rest of the world, it’s a lottery with nothing to back it. Along with a slew of regulations, all of the other markets that we discuss in this blog – housing, stocks, bonds, etc. – have a tangible backup.

But not crypto. Part of its appeal and phenomenal under-the-radar, black-market, dark-web growth was its detachment from regulation and reporting. But as we’ve seen recently, crypto is tanking.

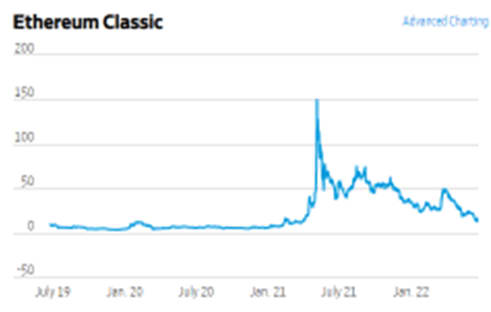

I feel like I pick on bitcoin a lot, so let’s look at another with a long-ish history (relative to crypto), Ethereum Classic, which launched in July 2015.

If you were lucky enough to get in early, you could have done quite well – if you also happened to cash out when it hit its

high of $176.16 on May 6, 2021. As I write this, it’s trading at $15.43. Ouch.

Yes, all trading is risky. But there are risks that you take because you believe in a company and its products and its management team and so on and even if you sell your shares, there are still tangible assets that will live on. With crypto, it’s solely the hope of finding a bigger fool who will one day buy your crypto tokens at a higher price than you paid. The thing is, though, that with no tangible assets to back them, they really could drop to zero – there’s no bottom, no stop-gap, no regulation, and no safety net.

Consumer Sentiment: Read the Tape and Consider Historical Behaviors, Too

Consumer sentiment is a significant indicator of the likelihood of recession because when people’s wallets are squeezed by rising costs for everything from hummus to houses, they pull back on spending; the same with businesses. And when that spending pullback occurs, it can signal a slowdown that may, or may not, result in an official recession.

The way I see it, though, there’s a bit too much reliance on consumer data that is 30 to 60 days behind in its accuracy.

A much better approach, if less empirical, is simply to read the tape now: What are you doing? How are your friends and family and coworkers and hair stylist dealing with rising costs? What changes to your habits are you making? What spending are you considering (or already) curtailing because of inflation?

This is the real-life, real-time indicator of consumer sentiment. If you’re feeling a little worse about your economics today than you did last week, then chances are good that others around you are, too. And if you’re feeling less concerned because, say, the Fed made a major interest-rate move and you’re feeling like the worst may soon be over and your family and colleagues echo that sentiment, then that’s likely to have an impact, too.

People Drive Markets and Economies – and Behaviors Are Generally Predictable

I believe that history repeats itself because humans are humans and at the end of the day, we all want and need the same things, even if the specifics of those – a carriage was drawn by two horses instead of one, a Model T Ford instead of a double-horse carriage, a Tesla instead of a Model T – change their forms. This need (or desire) to get things that help us survive and make our lives nicer leads, eventually, to normal patterns of spending.

And for that reason, what goes down eventually comes up again – it just may take longer to get back to where we were in January 2022, because we may never have the exact confluence of factors at play again.

Right now, trendlines are down, and taking significant risks now sort of feels like stepping in front of a moving train with the intent to get to the other side in one piece: For most people, it’s likely not the right strategy. But, if you know the limitations of what you can afford, then history has shown that there will be an upside – the basics of human behavior should ease some of the discomforts that economic setbacks cause.

We’ve been here before and we’ve gotten through it (and, with time, always better than before). Eventually, humanity gives a collective sigh of relief and we move on.