This week marks the two-year anniversary of this blog. For those who’ve been here from the start, it’s humbling that you check in regularly and I thank you. For those who have joined along the way – including those who may be new this week – welcome, I hope you’ll stick around, too.'

In this post, we’ve got a quick review of the first quarter of 2022. Indeed, things have certainly changed since I began posting two years ago. But as I always say, things always come back, they just come back differently.

Let’s see how we’re doing.

Russia, Ukraine, and the rest of us

While Russia’s potential for aggression against its neighbors has long simmered on the back burner, few people really imagined the mass destruction and loss of life that Ukraine is experiencing today.

Two years ago when this blog launched, the general thinking seemed to be that Putin was a well-armed bully who could certainly use his country’s military power to harass and potentially even harm another country. But I don’t think most diplomats and military leaders anticipated what is, essentially, genocide.

The slightest slip or perceived aggression could cause Putin – a lone wolf who, in his later years, seems to feel that he has nothing to lose in his quest to reassemble the Soviet Union – to tip into an all-out world war, complete with nuclear weapons. And for that reason, in Q1 2022 when Putin first invaded Ukraine, actions against Russia have been limited to sanctions.

I’ve said before that markets like certainty and stability and right now, we’ve got neither. It’s a mess. Where this goes is anyone’s guess and it’s what keeps me up at night now.

The hope is for a diplomatic solution but Putin seems hellbound to get his way.

Covid today

As 2022 began, we were in the thick of another variant emergence with Omicron.

If there is a brighter spot in the news today, it’s how far we’ve come in the fight against Covid-19. Cases are down, hospitalizations are down, and mortality is down, both as we look at the first quarter of 2022 and, most importantly, since it started just over two years ago. That the pandemic isn’t the lead headline most days now is something we hoped for but couldn’t imagine as the numbers climbed in wave after wave. And we’ve lost nearly a million people in the U.S. and many millions more around the world.

Still, it seems that even the most recent variants are contagious but less virulent. When someone we know tests positive there’s still a bit of fear – but there’s also some relief: we’re learning to live with it.

Stocks and bonds

The good news is that we’re past the point in which the pandemic is wreaking havoc on the markets. Instead, though, it’s the Russian incursion that’s causing volatility.

Perhaps what’s most surprising to me is how short-lived the levels of fear and pessimism are in the stock markets – much less so, certainly, than I’d have imagined on the precipice of a potential world war. Some say bear-market rallies are still bear markets; others say bear-market rallies are still rallies. I think it’s simply a sign of just how removed we are, currently, from the real impacts of this on Ukraine.

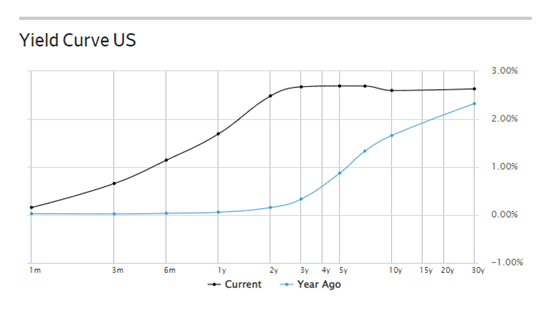

Bonds have been a little wild in this first quarter but in my opinion, they aren’t quite the canary in the coal mine that they historically were for pending recession, although I do think that one is likely. I don’t think it’ll be a whopper and I don’t know when it’ll happen, but it’s simply the natural cycle of the economy, so I’d put my money on yes, a recession is due, and I’d manage my investments accordingly.

Inflation and supply shortages

At an annualized rate of more than seven percent, inflation rages on. Gas prices are (comparatively) through the roof. And supply-chain shortages continue to cause weakness in our overall economic rebound.

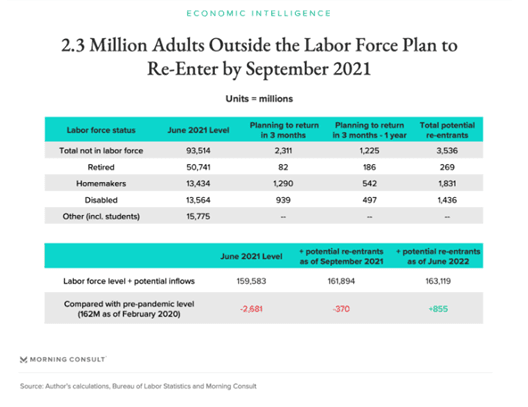

Speaking of unmet demand, the lack of people going back to the workforce is definitely dragging on our economic rebound. As we’ve seen in Q1, people who go back are getting better wages and benefits. The thing is that by the time most people realize that they actually do need actual jobs, a lot of employers will have rejiggered their workplaces so that they no longer need as many employees.

And then we won’t have people leaving jobs to make their millions with crypto and YouTube; instead, we’ll have millions of people wringing their hands about the steady paychecks, health insurance and office romances that are no longer available to them.

Residential real estate

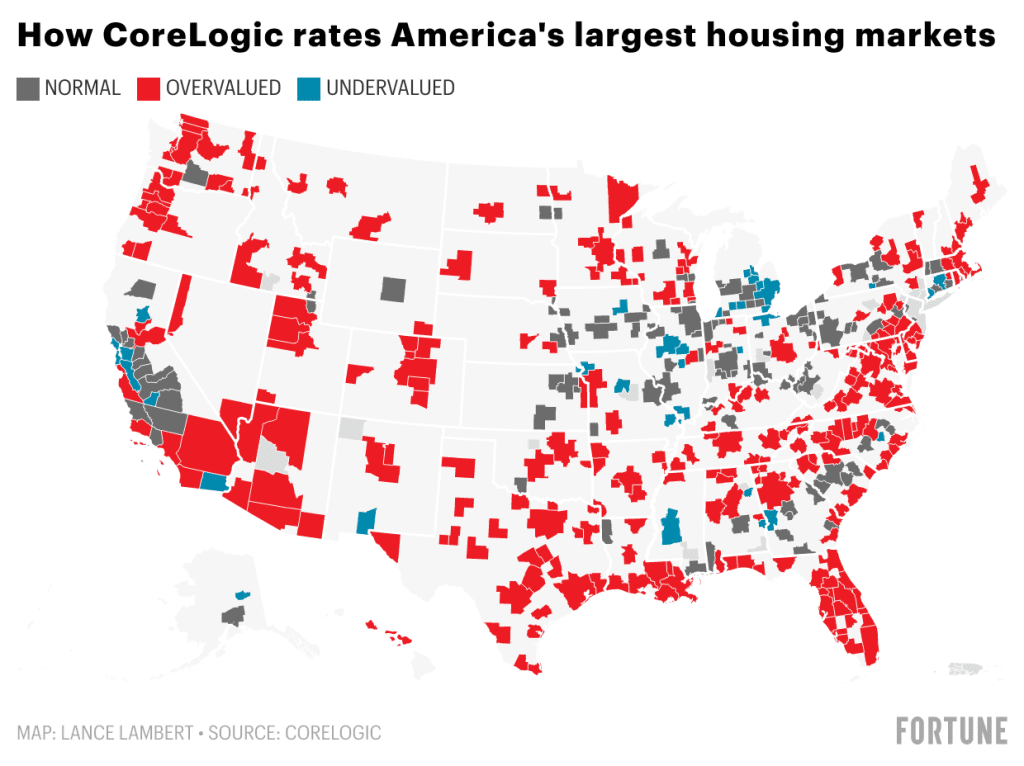

There’s still lots of pent-up demand and inventory remains very low. I think it’s also a sign that there’s so much liquidity out there that people and investment firms are simply buying up whatever they can get their hands on. And while some analysts and industry insiders see the rising mortgage rates slowing things down, especially in secondary and tertiary markets, I think the immense amount of cash floating around in investors’ pockets means that properties will continue to get snapped up at record and near-record prices.

“Last week,

the average 30-year fixed mortgage rate topped 4.67%—up from 3.11% in December. That’s a bigger deal than it might first appear. If a borrower took out a $400,000 mortgage at 3.11%, they would owe $1,710 per month over the 30-year loan. At a 4.67% mortgage rate, that monthly payment spikes to $2,067.

Not only do higher mortgage rates price out some would-be homebuyers, but it also means some borrowers—who must meet lenders’ strict debt-to-income ratios—will lose their mortgage eligibility.”

The problem is that it continues to drive sales prices and puts both homeownership and decent rentals out of reach for millions of Americans. And frankly, I don’t see how we can turn this around anytime soon. This, too, keeps me up at night because I worry about what this does to the social fabric of our country, which is already tattered.

I also worry because the dearth of housing means a huge reduction in transaction volume – the very foundation of the residential real estate industry. The result is that a lot of small, ancillary businesses in communities across the country are struggling now because they lack the volume they need to make money. If there aren’t enough homes to sell, there aren’t enough home inspections being ordered, underwriting being done, there’s not enough title insurance to underwrite, there aren’t enough property surveys to be done.

So, as frenzied as the housing industry sounds in the news, the reality is that it doesn’t play out quite the way you might imagine.

Elon Musk and Twitter: A genius… and a genius play?

Naturally, the SEC was up in arms over Elon Musk’s announcement of his purchase of more than nine percent of Twitter this week. But frankly, I loved it.

It’s his favored social media tool and it has been floundering in part because of censorship stances. As noted in the

Wall Street Journal:

“‘Given that Twitter serves as the de facto public town square, failing to adhere to free speech principles fundamentally undermines democracy,’ he [Musk] tweeted last month.”

So, he did what any brilliant and unconventional multi-billionaire would do, yes?

And while the news doesn’t exactly relate to a first-quarter roundup for the year, I think it’s worth mentioning that it very publicly sheds light on what many uber-wealthy investors do when a company they like isn’t making the right moves: they go for control. Now, Elon’s on the board and we’ll see how it evolves.

Stay tuned!