Like water and light, money finds its flow, its direction. But unlike water and light, money’s flow – and its volume and velocity – is based solely on the actions and reactions of human behaviors. And when money moves in a certain direction with high volume and velocity (as has been the case for the last several years), the impact is less of a gentle ebb and flow than it is a rogue wave, resulting in the kinds of bonkers anomalies we’ve seen in every asset class from stocks, housing, crypto and art to wine, cars and just about everything else.

That’s the crux of a conversation that I had with a friend the other day and it got me thinking about what’s so different with today’s money flow: If

my theory that human behaviors don’t change over time is true, then why is it so much harder to predict the flow of money now, if it’s based on behaviors that we’ve collectively experienced throughout human history?

If you’re a frequent reader of this blog, you know I say that it always comes back, but it always comes back differently.

What’s so different, of course, is that the force of the recent record upticks and current backslide – something that we haven’t experienced in more than a decade, save for a few early pandemic weeks – is driven by connectivity and speed.

In other words, at no time in the past have we had the combination of transactional technology-driven speed combined with social media.

The results leave me with a sense of whiplash.

Today’s Flow: Fast, Voluminous, and Volatile

Money movement has always been in anticipation of or reaction to human behaviors, that’s nothing new. The 180-degree shift here is that when a significant part of the workforce found themselves homebound and collecting paychecks or boosted unemployment payments along with stimulus funds, millions of retail-level traders entered the sphere.

The Carnegie Endowment for International Peace has a great report looking at the impacts of social media on investing, particularly from the lenses of cybersecurity risks and international economic security impacts. It also points to our startling new reality, one in which social media can drive velocity and volume not just for the sake of making a quick buck, but for a whole slew of political and ideological leanings that have nothing to do with the normal functions of the markets:

“Overall, in dollar terms, the phenomenon is still in its infancy. Participants may be legion, yet they invest relatively modest amounts. Nevertheless, retail traders can have a substantial impact when they, as a group, target smaller stocks. Social media offer an opportunity for these groups to form and act at low cost and high speed.

The wallstreetbets community on Reddit has emerged as a key forum for individual traders to exchange investment suggestions and coordinate actions. A few influential users taking an optimistic view of GameStop’s prospects were instrumental in building interest in the stock and orchestrating the first rally in early 2021. Before the GameStop episode, Wallstreetbets had roughly 2 million subscribers. By July 2021, it had surpassed 10 million. Even as several members suffered heavy monetary losses, vivacious discussion and trading continued.

Virtual trading communities have their own understanding of value. Participants certainly care about returns. Yet, as noted by economist Jayanth Varma, some of them maximize goals other than profit.9 Their trades are an investment and may also be a political, moral, or even an emotional statement. Collective beliefs, epitomized in catchphrases and memes, are cemented by online interactions. The epic narrative of ordinary people challenging the powerful looms large. Making money is conflated with making a point, as photos of trades are posted with captions like “just joined the fight”.

This attitude partly originates in the crypto-asset world, the original twenty-first-century mixture of techno-utopianism, defiance, and run-of-the-mill profit-seeking. Indeed, Wallstreetbets and crypto forums share a language, several players, and some trading apps. Although to different degrees, both are at the crossroads between internet phenomena and the formal financial system.”

Flowing Into Housing

Stocks are an easy place to witness this phenomenon, but it affects housing, too.

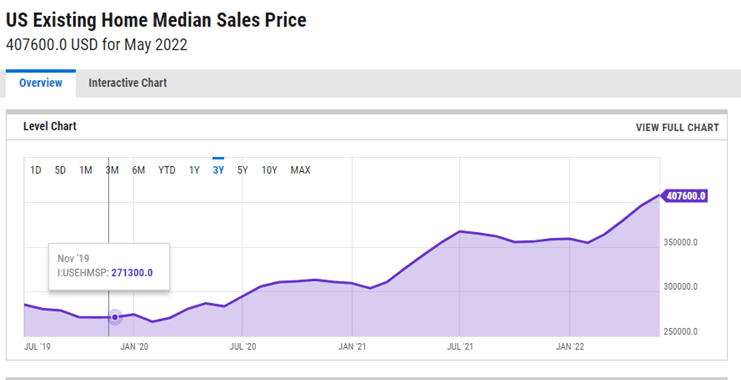

In November 2019, before there was even a stir about the pandemic, the US median price for an existing home was $271,300. Just about 30 months later, by May 2022, it had risen to $407,600. That’s just jaw-dropping.

It’s probably fair to conclude that soaring listing and sales prices weren’t simply the result of supply shortages, but of that fact, compounded by social media and online access to the MLS: Together, these drove competition to ferocious levels.

The Impacts Are Everywhere

Velocity and volatility go hand-in-hand throughout asset classes, too, and in this new investing environment, there are a few safe harbors that are protected from froth and frenzy. In my opinion, stocks picked through tried-and-true value-investing principles will continue to be strong bets. Housing, too, is a good investment for the long haul.

In the past, I’d have said that as we move forward (possibly through a recession) and eventually into better times, assets will slowly recover and all will be well. I would have told you that we’d endured some financial pain and learned some important lessons about investing – and we’ll approach our personal and collective economic recoveries wiser for the wear.

Once again, I’d have said, money will find its home.

And it will, certainly. But what throws me now is that while millions of people have had their savings and investments hammered by steep declines, I think we’ll see a lot of the same mistakes made again – because, once again, the combination of behaviors and social media and tech means that millions of people will look to quickly win back some of what they lost over these last weeks and months. And because of this, another favorite adage – that it takes decades to build great wealth but only minutes to lose it – has been bent to warp speed. From what I see now in the markets, too, there’s a lack of rationality for many of the moves that are being made.

That leads me to think that the extreme gamification of the markets that I’d hoped was something of a blip, ignited by the pandemic, is likely to stick around and we’ll see big waves, not predictable tides, of money flowing in and out again, and again, and again, at a velocity that’s now become embedded in our behaviors.

So, while I’m fairly comfortable predicting that a sense of calm and normalcy may truly be a thing of the past, this new reality makes everything else harder to peg. What can you do? I wouldn’t ignore historical data because I think there are always valuable lessons, but I also believe that it’s more important than ever to read the tape, as that will give you a better sense of the current zeitgeist and help you better predict future behaviors.

In my opinion, the real issue is whether (and how much of) your financial strategy will involve guiding your investments through calmer waters knowing that it may take time to reach your goals, and how much of it includes tossing your investments into the rogue waves that everyone’s hoping to catch. Every course has its risks and potential rewards and money will always find its flow.