We tend to think of the economy in terms of numbers: employment data, growing or shrinking wages, rates of investing and saving and the like. In essence, though, it’s a social science and, in my opinion, it all boils down to perception: Human experience is perception-oriented and what we perceive becomes what we believe.

That’s why, earlier in the pandemic, many people perceived that they were doing relatively well, financially speaking – money flowed in because their jobs were protected or their unemployment was boosted or they received stimulus funds. Many people used newfound excess income to invest in assets, boost savings and buy houses (at ever-increasing prices). And they shopped and shopped and shopped from home.

All of the horrors of the pandemic aside, these last two years left millions of Americans feeling fairly flush from a financial perspective. We’ve had the perception that all is well.

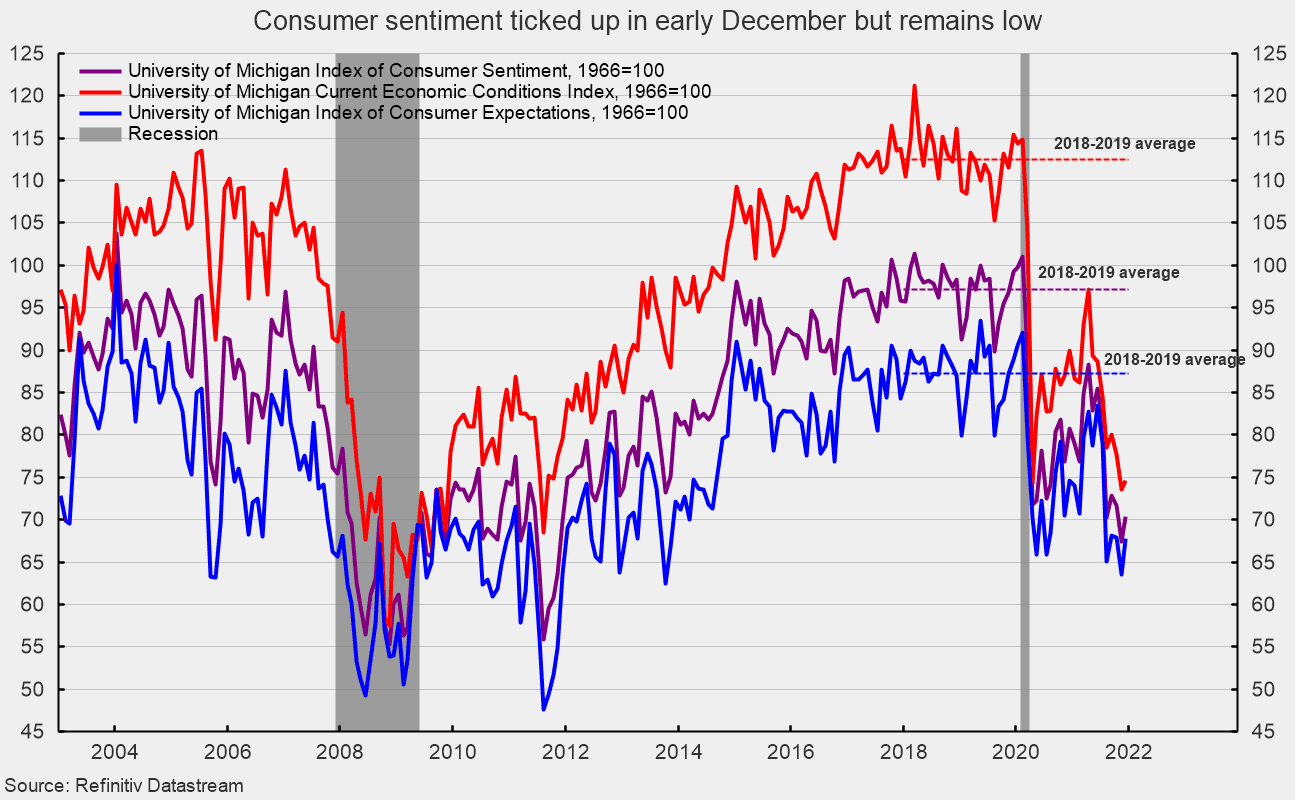

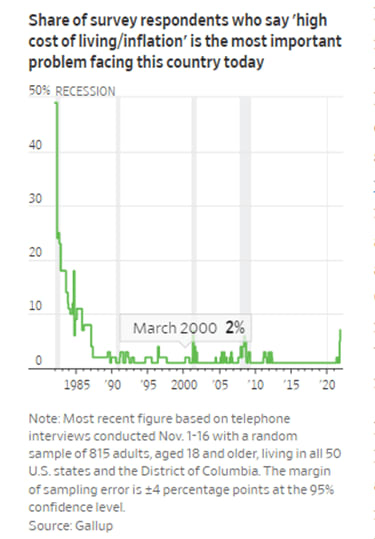

Now, we’re looking at the highest inflation in many decades and it’s no longer viewed as temporary – and I don’t think that annual inflation rates of 6-7% are out of the question for the next couple of years. We’re starting to feel it at the grocery store and at restaurants and all over Amazon and now, we’re not feeling quite as good as we did.

The recent

Wall Street Journal article, “How Do You Feel About Inflation? The Answer Will Help Determine Its Longevity,” does an excellent job of laying out how emotions and perceptions factor into modern economic theory (I apologize if you can’t access the link…but here are a couple of excerpts):

“The Fed and many private forecasters assume consumers adjust their expectations gradually and continuously, implying they’ll have ample warning before inflation expectations become dangerously unanchored. But it’s possible households’ inflation concerns tend to be binary. In other words, they either care a lot or not at all—there’s no in-between…

…Robert Lucas, another future Nobel laureate, went further. He hypothesized that expectations are shaped by more than past inflation, such as by conjectures about future economic and policy changes. Taken together, this macroeconomic overhaul implied inflation is determined almost entirely by what the public expects it to be over time. Policymakers could influence price developments by shaping those expectations, such as by announcing a numerical inflation target.

The following decades seemed to prove this theory.”

Now, the majority of Americans are realizing what folks with lower incomes have always known: inflation hurts. And when it hurts enough of us, it creates a lack of trust in our federal government – the same entity that kept us afloat these last two years.

Mikensian Theory: How to tame inflation in 5 steps

When I started drafting this post earlier in the week, I had a list of steps – my “Mikensian Theory of Inflation Mitigation,” if you will – that I’d take if I was in a position to impact policy. As I updated the post, Jerome Powell – who, as chair of the Federal Reserve, actually is the person who is best positioned to determine policy – must have been reading my mind, because the Fed announced that they’ll be taking several of the steps that I would have taken, if I was in his shoes.

The first step is already in motion and the second, raising interest rates, will begin in 2022, per Powell’s announcements. We’ll look at them a bit more, as well as a few others (starting with Step 3) that I believe are necessary and what they could accomplish:

- End the bond-buying program: The Fed’s plan is to accelerate the timeline for tapering the strategy of buying back billions of dollars in bonds each month (a tactic that the Fed’s been using to hold down interest rates and spur investment in growth assets during the pandemic).

- Raise interest rates: The Fed also announced that it foresees raising interest rates up to three times in 2022. Raising rates tends to slow the economy, because when borrowing becomes more expensive, people do less of it, whether that means investing in businesses or buying homes. The other challenge with this painful but necessary step is that raising rates too much, too soon could trigger a recession. It’s a delicate balance, finding the right amount of pressure to slow things without slamming on the brakes and it’s particularly tricky now, as the pandemic continues its unpredictable and treacherous march around the globe and back again.

On this point, I think engineering a slow recession by adding about two percent annually to current rates is what’s needed. It’s not enough to throw the markets out of whack, but it is sufficient to slow things down. And I’d tell the world about what we’re doing and why and then I’d leave the rates higher until we have lasting results.

- Stop adding liquidity: The federal government has pumped trillions of dollars into the economy over the last two years and much of it was critically needed. Now, though, what’s already flowed in needs a bit of time to make its way around our economy. While I support the intentions behind additional funding, more liquidity will only add fuel to the inflationary fire and thus, it will ultimately do more long-term harm to the people the programs are intended to help.

- Reconsider manufacturing and distribution at home: The supply-chain issues were vastly exacerbated by the pandemic, but they’ve also presented opportunities to rethink what and how much to manufacture here in the U.S. On-demand ordering with overseas manufacturing worked for a while, but is it prudent now to bring some of it back home? Can it be profitable? Will Americans pay for U.S.-produced goods? I think there are interesting challenges and opportunities – and choices – to be made, both on the part of businesses and also on the part of consumers.

- Make vaccinations mandatory. Barring a miracle cure, we need to use the one tool that we have to get this under some semblance of control: the vaccine. It’s not to say that across-the-board inoculation will stop this or any coronavirus from mutating, but it will slow down the spread and ultimately lessen its impacts, physically, emotionally and economically. I don’t see any other way around this.

An exercise in economic theory

While there are many economic theories floating around, there are four that are frequently cited as modern macroeconomic theories (since the 1930s, following the Great Depression); prior to that, “laissez-faire” macroeconomic theory dominated (thus, it’s known as “classical economic theory”).

Here are modern macroeconomic theories, along with snapshot summaries (from

Reference for Business, which has longer versions of each), with a somewhat longer explanation of Keynesian theory here, as all the rest are based on or a reaction to it:

- Keynesian economics: “The classical economists had argued that the self-adjusting market mechanism would restore full employment in the economy, should the economy deviate from the full employment path…the Great Depression, however, showed that the market forces did not work as well as the classical economists had believed…English economist John Maynard Keynes…explained that … Wages and prices are not as flexible as classical economists assumed…Keynes further argued that classical economists had ignored a key factor that determined the level of output and employment in the economy—the aggregate demand for goods and services in the economy from all sources (consumers, businesses, government, and foreigners)….If the level of aggregate demand is low, the economy would not create enough jobs and unemployment can result…The central issue underlying Keynesian thought was that those who have incomes demand goods and services and, in turn, help to create jobs. The government should thus find a way to increase aggregate demand. One direct way of doing so is to increase government spending…The early Keynesian economists thus recommended that the government should use fiscal policy (which includes decisions regarding both government spending and taxes) to make up for the shortfall in private aggregate demand and to create jobs in the private sector….

…Modern Keynesians (also, known as neo-Keynesians) recommend monetary policy, in addition to fiscal policy, to manage the level of aggregate demand. Monetary policy affects aggregate demand in the Keynesian system by affecting private investment and consumption demand….An increase in aggregate demand under the Keynesian system, however, not only generates higher employment but also leads to higher inflation. This causes a policy dilemma—how to strike a balance between employment and inflation. According to laws that were enacted following the Great Depression, policymakers are expected to use monetary and fiscal policies to achieve high employment consistent with price stability.”

- Monetarism: “The original proponent of monetarism was Milton Friedman (1912—), now a Nobel Laureate. The monetarists argued that while it is not possible to have full employment of the labor force all the time, it is better to leave the economy to market forces. Friedman contended that the government’s use of active monetary and fiscal policies to stabilize the economy around full employment leads to greater instability in the economy. He argued that while the economy would not achieve a state of bliss in the absence of government intervention, it would be far more tranquil.”

- New classical economics: “The new classical economists…provided a theoretical framework and empirical evidence to support the view that neither fiscal nor monetary policy can be effective in altering the output and employment levels in a systematic manner…Thus, there was no point in conducting monetary and fiscal policies, since market forces are not amenable to such manipulations.”

- Supply-side economics: “Basically, supply-siders emphasized enhancing economic growth by augmenting the supply of factors of production such as labor and capital. This would be accomplished done through increased incentives mainly in the form of reduced taxes and regulations. Ronald Reagan, for example, used a major tax cut as a part of his fiscal policy. The supply-siders, in general, want a greater role for the market forces and a reduced role for the government.”

Here are your challenges: While most economic theories are eventually shown to be flawed, they generally also have some kernels of lasting truth. Considering each, which do you think best incorporates

reading the tape? And what new theory would you develop to meet our changing world?